Poland is currently enjoying GDP growth that is very robust. Despite a recent uptick, headline inflation appears to have stabilized and the labor market remains tight. A number of factors have contributed to the country’s economic health: Domestic demand remains strong – a seasonally adjusted figure of 5.3% year-on-year in the second quarter; the central bank continues to pursue its relaxed monetary policy; and, exports to the Eurozone thrive.

For the time being anyway, Poland’s economy is well balanced with little sign of any over-heating. And, in a welcome surprise and despite pre-election promises, the government has not over-indulged in either social or populist spending.

One still has to wonder though just how the current administration will address effectively the extremely sluggish growth in fixed investments.

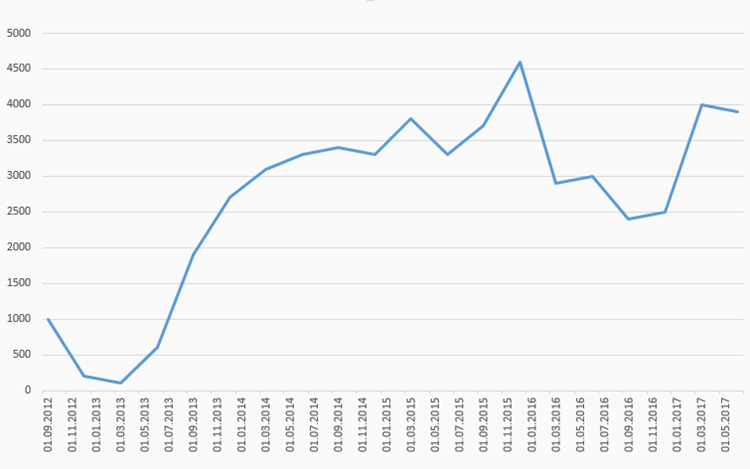

Polish GDP Growth

(9/28/2012 - 6/30/2017)

Source: Bloomberg

Get the latest news & insights from MarketVector

Get the newsletterRelated: