When thinking about hotbeds for startups and unicorn IPOs, there’s Silicon Valley, Israel, and China. However, after a banner year for India’s National Stock Exchange, could India be the next hotbed for unicorn IPOs.

According to a report issued by Goldman Sachs in 2021, the India stock market, led by the National Stock Exchange (NSE) could grow to more than $5 trillion by 2024 to become the fifth largest market in the world. The report also suggests that more than 150 companies could go public in the next three years, adding as much as $400 billion of market value.

In India, 2021 saw more than 40 companies become unicorns, start-ups raise more than $10 billion in IPOs, and the first ever billion-dollar IPO (Zomato).

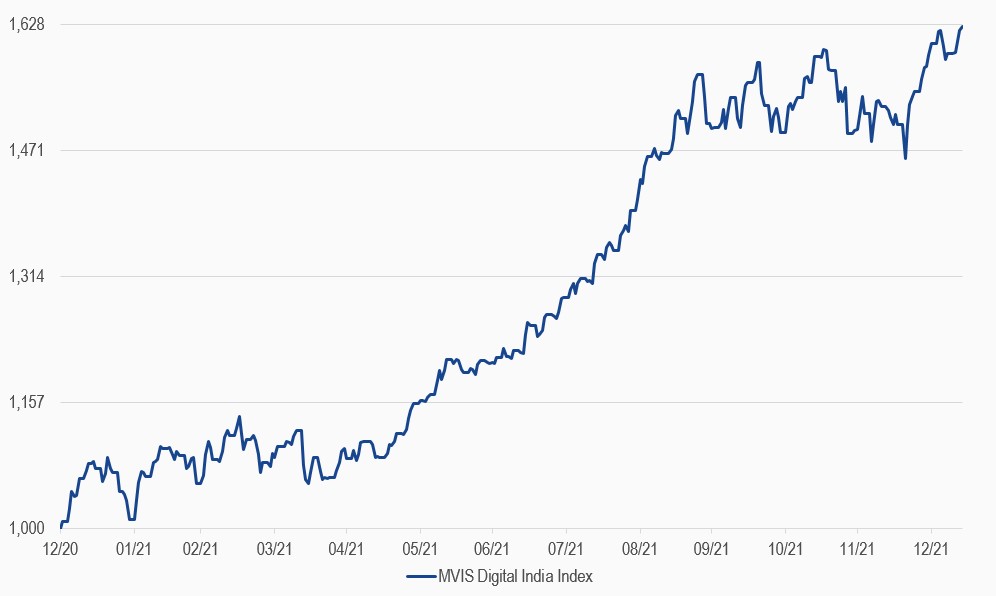

The market has responded well to the infusion of money and the increased frequency of IPOs. A good indicator for these upward trends is the MVIS Digital India Index (ticker: MVDIND). The index, which tracks the performance of the largest and most liquid digital companies in India, is up more than 51% over the last year, as of Wednesday, January 13th, 2022.

With 81 total unicorns in India, and an injection of swaths of venture capital money into the Indian startup ecosystem, the Indian public market looks primed for an explosion in the coming years.

MVIS Digital India Index

31/12/2020-13/01/2022

Source: MV Index Solutions. All values are rebased to 1000. Data as of 13 January 2022.

Get the latest news & insights from MarketVector

Get the newsletterRelated: