Over the last five years, EM economies have been impacted by lower commodity prices, the 2013 Fed’s Taper Tantrum and various political developments. These dynamics altered many EM economies and their macro-economic equilibrium, leading to some significant EM currencies depreciation and significant EM equities underperformance.

Additionally, EM countries experienced a rapidly expanding middle class, social changes caused by, for example, increasing urbanisation and digitalisation, as well as modernisation in the business world. These dynamics provide multiple sources of growth over the long term.

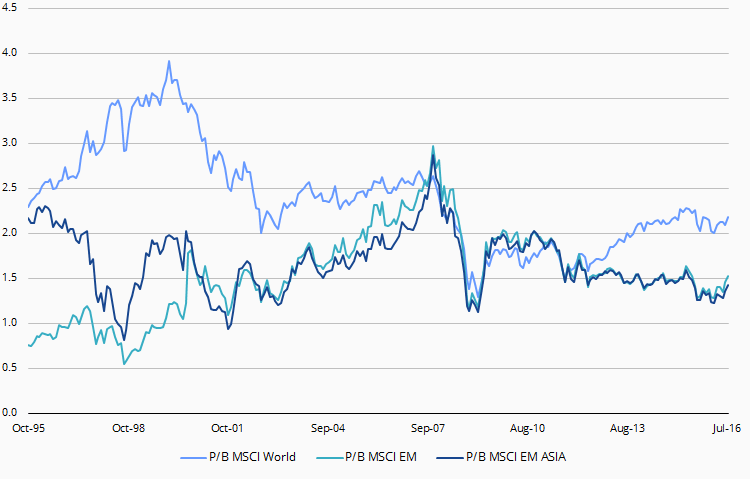

EM stock markets are now trading at valuations close to levels seen at the time of the 1998/99 crisis. In addition, EM currencies have depreciated significantly over the last years and are showing signs of stabilization. Improved EM economic fundamentals are pointing to a cyclical economic upturn that will typically drive corporate returns higher. Furthermore, the Brexit news is set to drive a longer monetary accommodative stance in developed markets. This is likely to provide EM’s central banks with further monetary leeway to support their economic green-shoots.

Emerging Equities: Valuations close to crisis level and at cyclical low levels

Price to Book of Developed Markets and Emerging Markets

Source: Bloomberg as at 31 July 2016. Past performance is not a guarantee of future results.

About the Authors:

Pascal Menges is the Portfolio Manager for the LO Funds– Emerging High Conviction within Lombard Odier Investment managers’ Equities Group; he has been Portfolio Manager of LO Funds-Global Energy since inception of the Fund in December 2010, and was Portfolio Manager for the 1798 AOG Energy Fund from September 2011 to May 2013. Additionally, he was Head of Equity Research for those two Funds. He originally joined Lombard Odier in May 2006 as Head of the Industrial Team and Senior Energy Analyst in the buy-side research department of the Private Bank.

Prior to joining, Pascal was a sell-side analyst at Exane BNP Paribas, covering the European energy sector after holding the same position at Oddo Pinatton from 2001 to 2002. He began his career at Elf Aquitaine/Total in 1996, holding various financial positions in auditing and mergers and acquisitions before overseeing the president’s reporting.

Pascal earned a master's degree in finance from Reims Management Business School (France) and benefited from the MBA’s exchange program with the Queensland University of Technology (Australia). He also holds the Certified International Investment Analyst (CIIA) designation.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.

Get the latest news & insights from MarketVector

Get the newsletterRelated: