When we talk about growth, it includes not only annual production growth, but also operating margin and reserve growth. For example, if a company produces 1 million ounces of gold today, and is projected to produce the same amount next year, many would consider it to have zero growth. But, if next year’s ounces are produced at a lower operating or capital cost, then cash flow will grow. This is growth!

If the company produces the same number of ounces the following year, but through exploration or acquisitions it manages to increase its reserve base in order to sustain this production level for longer, its net asset value will grow. This is growth!

In other words, we view growth as anything that grows the value of the company over our estimated operating horizon. Thus, value creation rather than growth seems to be a better term to define the success of a company’s strategy.

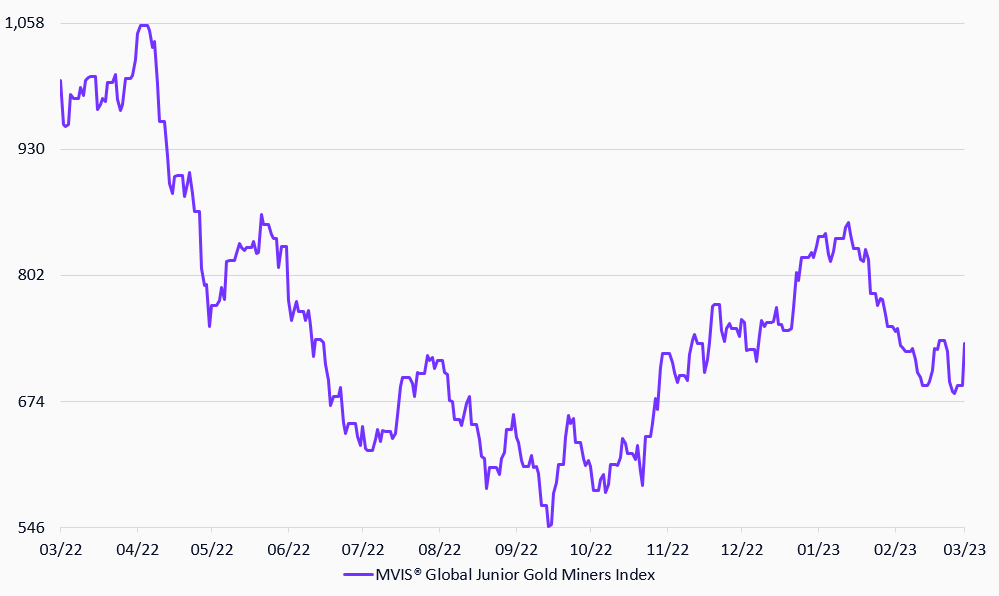

MVIS® Global Junior Gold Miners Index

3/13/2022-3/13/2023

Source: MarketVector IndexesTM. All values are rebased to 1,000. Data as of March 13, 2023.

Get the latest news & insights from MarketVector

Get the newsletterRelated: