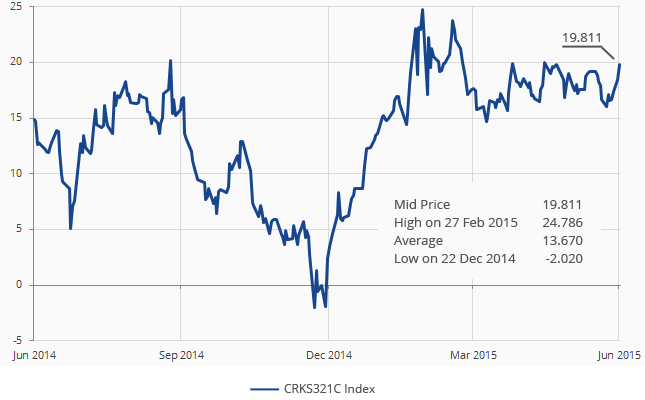

Refiners «crack» crude oil and turn it into refined (petroleum) products. That is, they break up its long-chain hydrocarbons into hydrocarbons with shorter chains. If the price difference, or «spread», between the crude oil they refine and the refined products they produce is positive, then the process is profitable. If it's negative, the process is not profitable. The crack spread, then, represents a theoretical refining margin or an indicator of potential earnings.

However, since both input and, in particular, output, vary across refineries, the spread is, de facto, a proxy. One formula commonly used in the oil industry is the 3-2-1 crack spread. The basic assumption here is that from every three barrels of crude oil, refiners produce two barrels of gasoline and one barrel of distillate fuel (for example, gasoil or heating oil).

Bloomberg WTI Cushing Crude Oil 3-2-1 Crack Spread/U.S. Gulf Coast

Source: Bloomberg, Data as of 10 July 2015

Get the latest news & insights from MarketVector

Get the newsletterRelated: