… given everything that is currently going on in the world?

Gold has been in a secular bull market since December of 2015, when it bottomed at around $1,050 per ounce. Gold’s performance so far is no match for the other secular bull markets in the ‘70s and the 2000s. The current bull market is driven by similar macro-economic and geopolitical risks, with some drivers made worse by the pandemic.

There is one stark difference that may explain the weaker gold performance so far in this bull market. The U.S. dollar was in a secular bear market in both the ‘70s and 2000s. From 1971 to 1978, the DXY1 declined 45% and from 2002 to 2008 it fell 41%. However, since December 2015, the DXY has gained 5.2%, as it has bounced around in a sideways trend that is currently testing its 20-year high. While gold and the U.S. dollar sometimes trend higher together in periods of acute financial stress, the normal relationship is inverse.

We believe the firm dollar has muted gold’s advance in the current bull market. And, while we believe gold prices are heading higher, until the dollar trends lower, gold may not see the spectacular gains of past secular bull markets.

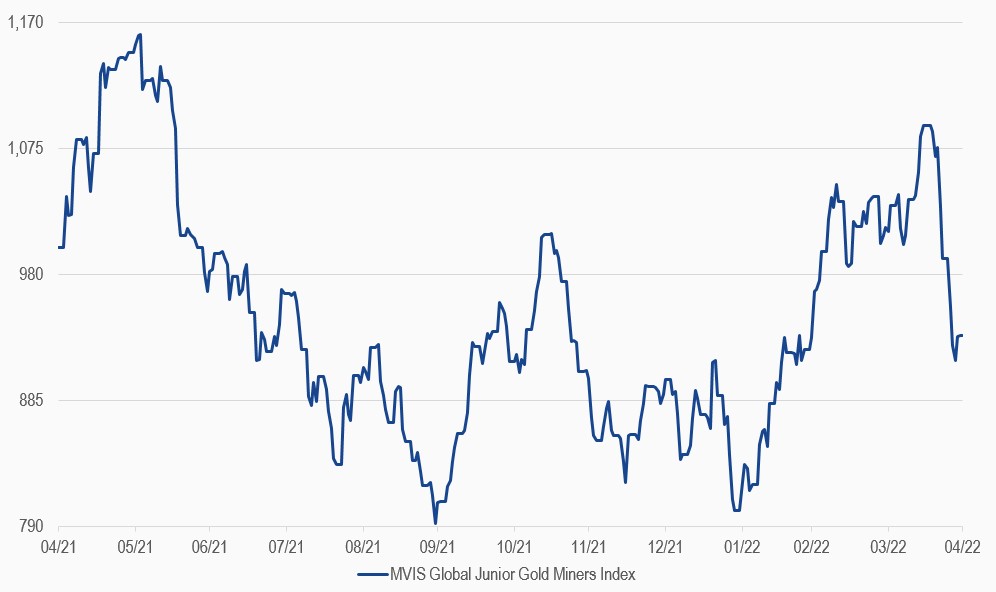

MVIS Global Junior Gold Miners Index

30/04/2021-20/04/2022

Source: MarketVector Indexes. All values are rebased to 1,000. Data as of 30 April 2022.

1Source: U.S. Dollar Index (“DXY”) indicates the general international value of the U.S. dollar by averaging the exchange rates between the U.S. dollar and six major world currencies.

Get the latest news & insights from MarketVector

Get the newsletterRelated: